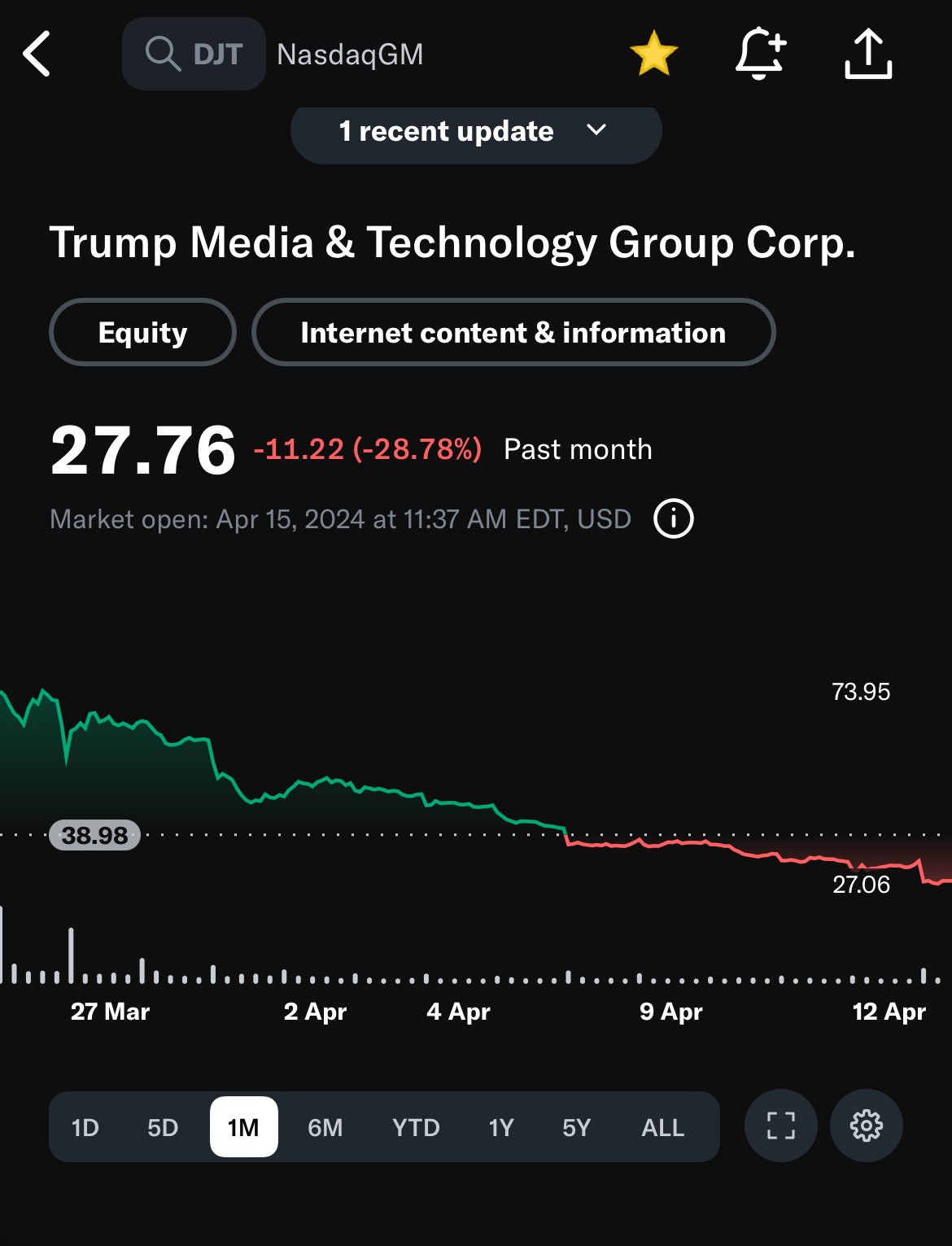

Trump Media & Technology Group’s stock is tumbling again after the company announced a massive new influx of shares. The struggling company is rapidly losing money, and a new stock offering could help it stay afloat.

But there’s a downside to going back to the market with new shares: A new public stock offering of 21.5 million shares announced Monday would add more than 15% more stock to the publicly available shares of the Truth Social owner. That would substantially devalue existing shareholders’ stakes — including that of former President Donald Trump.

Shares of TMTG (DJT) fell more than 15% Monday. The stock had rocketed higher in recent months in anticipation of merging a blank-check acquisition company with Trump’s media business. But it has lost more than 60% of its value from its peak on March 26, the day after the merger was completed and it started trading publicly as TMTG.

Someone should tell that tardigrade that’s not where you position the bow when playing violin

You’re thinking of a human grade violin. This one is tardigrade.

lmao, every time…

in before someone notices it’s a cello, lol

Dammit I was so excited to tell that person it was a cello!

That tardigrade is so jazzy right now.

But… You still wouldn’t be playing below the bridge

Some folks did.

Weird folks. But folks nonetheless.

If the difference between a violin and a cello is its size, who knows wtf that is.

Picolin

deleted by creator

My eyes nearly rolled out of my head seeing that he had the stock symbol be his initials, but after a moment of thought, I realized it must be killing him to see “his” value plummet. That’s wonderful.

There’s history there. This isn’t the first time.

https://www.cnn.com/2024/03/25/investing/trump-stock/index.html

I guess. It’s still billions of dollars.

Lol @ the downvotes. I’m just guessing he’s still happy that this is worth a bundle.

Maybe. I doubt it’ll hit penny stock status before he can sell, but one can always hope.

He just got kicked off the billionaire list… He’s a broke bitch. Personally I can’t wait for Putin to come collect the half a billion he owes.

He got kicked off the Forbes list of richest billionaires, which isn’t the same thing as not being a billionaire. Or an accurate list for that matter.

Only his accountants know what he’s actually worth, and they’re paid to lie regardless.

This is what happens when you just “print more money.”

And don’t have military bases in most countries to force everyone to keep buying it.

Yet.

If he doesn’t have any military bases, then why does he have all those tanks?

Usually, if you’re running for president, you want to invest money into political or media machines that are going to create true believers for you

If you’re taking the already existing true believers, who think you’re a business genius and all your prosecutions are politically motivated and the election was stolen (like really honestly think all of that is what happened, because they are too deep sunk in propaganda to even see the surface)… and creating an opportunity for them to lose a bunch of their own money by investing in your company, like really be exposed on a personal unavoidable level to how much of a fraud you are and always have been… you’re doing it wrong.

I get it. It’s desperation; you have to siphon money out of them because you need all you can get right now. But it still seems like a tactical error, like there must be another way.

Usually, if you’re running for president, you want to invest money into political or media machines that are going to create true believers for you

No. Usually if you are running for president, you put your investments into a blind trust.

No. Usually if you are running for president, you put your investments into a blind trust.

what with his faith in humanity and all.

The 70’s are over. Carter putting the farm in a blind trust was rewarded with Republicans bribing Iranian terrorists to keep the hostages longer. Disco is dead.

The 70s, the 80s, the 90s, and the 2000s. Presidents aside from Trump have always put their investments in a blind trust.

Like whats your point? Are you saying Trump would or would not put his stake in Truth social in a blind trust?

I’m correcting you when you implied that this a practice of decades ago. It is not. It has been the standard. Trump is the exception. I don’t foresee that changing. So Trump failing to do so is even worse than if it was some outdated practice.

Oh cool. So he’ll be putting his shares in a blind trust then?

Even the blind trust knows that’s a terrible investment.

In all seriousness, what’s the over under whether the company will be delisted from nasdaq this month?

Disco didn’t die. It evolved.

OP was referring to the campaign

It’s the deep state shorting the stock bro. Trust me bro. Just keep buying the stock bro.

Trump’s social media stock is gonna bring down wall street, make you rich, stop the liberals, suck your dick, stop communism, let you suck its dick, stop the RINOs, and help Russia stop the nazis.

/$

Are you implying that Trump believers with faith deep enough to buy the stock regularly (eg they’re not an oligarch/enterprise doing it to bribe Trump) is thinking this logically?

People either vote for him for other reasons (tax cuts for the rich, conservatism, fear for the border or racism) or are deep enough into a cult to disregard anything.

Yeah, maybe. His cult is absolutely surrounded by a singular media drumbeat of him being smart, him being rich, him being a winner, the Democrats being bad and evil and jealous and cheaters at the election and just every bad thing in the world. I’m not saying that losing a whole bunch of their personal money because they operated on that model will definitely in itself break them out of the illusion; I definitely think some of them are in too deep even for direct personal experience to impact their perception (especially if the drumbeat is continuing exactly as before). But it’ll at least give them a saving throw or something I think.

If you have made it your whole life through cheating, and you think cheating worse than everybody else makes you smart, cheating becomes the only way you know to accomplish anything.

Matthew Tuttle, chief executive of Tuttle Capital Management, says that management would be “stupid” not to issue new stock, even though the move will upset shareholders. “Whenever you see a stock jump, like you saw this jump, a secondary offering is always a risk,” said Tuttle.

Is this moron holding his chart upside down?

Nah he’s just got a version that Donnie boy sharpied an upwards trend line onto.

Lol, it’s at 1/3 of its peak a few weeks ago.

Oh the sweet schadenfreude.

It jumped into a ten dollar loss, but there was no actual gain to be seen day over day

“Trump stocks tank” is every other headline over the last year, yet somehow they still exist.

So not only does each stock holder own less of the company as a percent but the actual value of their stock is also lower.

This is normal for a company, when it releases more stock, as the cononay foes not magically become worth more. What’s odd is releasing more while its already tanking and needing the funds so soon after it floated.

I winder where the money is going?

Company does not

This typo was hauntingly difficult to parse

Covfefe

Nowhere; it’s not real money. It’s hypothetical money.

Money from new stocks isn’t hypothetical, it’s cash traded for ownership. They just had a successful ipo and then plummeted, so they should have quite a bit of real money. Minting new stock in this situation is basically the opposite of what you’d do if you wanted your share in the company to have value. It’s the behavior of a desperate embezzler who either has no idea how to not get caught or knows they’re going to and wants to take the money and flee immediately

The value is hypothetical. Trumpnvant sell for 6 months. Sonsoneone is getting money when people Bought the shares. It may have gone to the company of shares were diluted, but then why do they need money so quickly?

Wouldn’t people still own the same percentage, but the company itself just own less?

I don’t believe they can just create shares out of thin air. The company would typically own a certain amount of shares the entire time and then sell the ones they own.

So if you had 1% before and the company owned 50%, they might decide to sell half of their shares so they now only own 25% but you still own your 1%. You don’t just magically have 0.5% now.

The reason the shares drop in price when this happens is because it’s a sign that the company is either in financial trouble and seeking for a quick influx of cash or it’s a sign that the company doesn’t have much hope for its future success and wants to sell now before the price naturally starts to go down anyways.

So… Not quite how it works. The company gets an authorized number of shares which it can then issue out, or sell to shareholders.

If you own 100 shares out of the 1000 they are authorized, you own 10% of the company.

Now if they request and are authorized more shares (which is what happened here), your stake in the company is cut down. Let’s say they get authorized and issue another 1000 shares, bringing them to 2000 total shares. You now only own 5% of the company.

And with these new shares hitting the open market, prices will drop because now there is “more supply than demand” (it’s an easy way to think about it). In theory the whole thing will eventually even out, but that generally doesn’t happen here because the value of the company hasn’t changed.

This whole thing is different compared to a stock split, which affects the price and the number of stocks, but not your overall stake in it. If a company does a 2:1 split, your shares will double, but the price per share will be cut in half. 10 shares at $10 now becomes 20 shares at $5… Your stake is still at $100

It can be either. Calling it a new release is ambiguous. They also call it a new stock offering, which is also ambiguous but is why I presumed dilution.

https://www.activefilings.com/information/shares/

How to increase the authorized shares of stock? An increase on the authorized shares of stock has to be formally requested to the state by filing “articles of amendment”. A shareholders’ meeting is ussually required to authorize an increase of the shares since their ownership of the company will be affected due to this change.

lol, fkn idiots

Couldn’t even follow through on a plan that even redditors got to work.

Anyone know the easiest way to short this stock?

As a general rule, if you’re hearing about something from the news, it’s already too late to profit from it.

This might be the exception, but I’d temper any expectations accordingly.

It’s supposedly the most shorted stock on the market, which I think means it’s going to be damn difficult to turn any sort of profit on it.

Just add DJT to the stock tracker app on your phone and pay yourself in schadenfreude as it rapidly and inevitably approaches zero.

Just watch it. It’s doing it to itself, lol.

The short answer is, don’t bother. The premiums are so baked in that it will tank, that you’d be lucky to make any money.

Something something options are the way forward something wallstreetbets

Just stop fucking around and buy SPY.

You stop fucking around and trade futures!

Just buy puts. You can buy them right now.

Buying puts are crazy expensive, showing just how shitty the stock is. For all puts a month out, it’s gotta lose 25% of its current value just to break even.

With that being said, it’s probably a safe bet.

It’s not really a safe bet, one of the reasons options are expensive is because they price in the very high volatility of the stock. You can be correct about the future direction of a stock and still lose money on an option based on how much the volatility changes or how long it takes to make that move. And with enough shorting there could even be the risk of a squeeze. Best to just stay far away from that stock.

sell calls to fund put buying name a more iconic duo

Oh no. (violin playing)

Just print more money! That’s never caused massive inflation before!

That’s kind of interesting, but I’m always wary of correlations

Because it was a SPAC I think the stuff before this year is essentially unrelated.

So what would happen if a lot of us liberal minded folks bought up all this worthless stock on the cheap? Would maga fucks pay us (by buying back our interest at a healthy margin) not to influence the trump media group with demands for “woke” media to profit on our investments? 🤔

No, they probably wouldn’t purchase it, nor is there enough shares for sale to influence the company much. All it’d do is raise the value of shares. If you want to throw your money away, at least do it in a way that doesn’t benefit these assholes.

There has been a pretty steady stream of these articles and then you look at the chart and its like…

Eh. Its in the chop zone. All stocks have been volitle af since 2020.

Always look at the bright side of life

Reddit (rddt) is in the “chop” zone. At the current market cap Truth Social has valued their users at $4115 each. Facebook only values their users at $299.25. If they assumed the same as Facebook, the stock would be valued around $4.54/share!

That’s being generous af

I mean, just throwing it out there, but I think you are trying to do a bit of fundementals on this. Which is like, fine, and on a sane planet is exactly how you should think about things.

However, we do not live on a sane planet, and when you look at stocks like TSLA, APPL, GME, I mean fuck, basically everything. You look at startup and VC valuations, like the whole fucking thing is so detached from fundamentals. I guess there are some classes of stock where fundamental analysis is how you should determine a valuation, but clearly, fundamentals have not been driving valuations for a very very long time. Its that “something else” that is driving price.

So that being said, does Truth Social have that something else? Truth social is a joke of a social media company. Its not the product or the service or its user base you would be gambling on for this one, its one asshole named DJT. I personally would put a negative value on its users/ userbase. From an advertiser perspective, they might actually cost me money by engaging with the platform That being said, consider if Donny Tinyhands wins in November, what do you think happens to Truth Socials price? Like it exists as a stock SPECIFICALLY to enrich Orange Mangosteen. It would go gang busters. Why? Because he’s corrupt as fuck and the stock is a vehicle purely for self enrichment. You think he wont self deal? You think Republicans in the house or Senate would do anything more than wag a finger? Fuck some of them might just end up becoming hypemen for whatever boner-pills or kettle bell testosterone supplements and being schlepped on the platform. Fuck, if Biden doesn’t start doing better, we’ll probably find out Pelosi has gone long.

I would look at the stock as a somewhat real time indicator of Donald Trumps chances in the 2024 election. If people think he’s going to win, they should buy the stock. If they think he’s going to lose, they should sell/ short the stock. And it may even be backwards from that, because of Trumps cash position and his legal entanglements. The more volatile/ lower the price goes, the less he’s able to use it as leverage to increase his cash position. He may end up relying on that to continue to fund his legal battles and presidential campaigns.

Tldr: fundementals smundementals.

I don’t disagree. There is definitely some level of detachment from reality on many stocks. His is more detached than the rest but that doesn’t mean the fundamentals predict its reality. I also don’t doubt it would be a perfect vehicle for anyone to lobby his influence. But before/if he gets in, this baby is going to see the floor. Don’t know if the Saudis or Russia would want to put up the billions to prop it up just hoping he gets in.

If you want a sane valuation of a stock, the only value is the dividend, unless you want to be on the board. All other value is the belief someone will pay you $1 more for the thing you have which has no other value than the above.

I don’t know much about stocks, but on every time span chart this stock looks like it’s in total disaster mode

I mean if you were looking at META in November 2023, you would say the same thing right? It was down 75% from ATH. It was dropping WAY faster than Truth social has been. I mean the metaverse? C’mon.

Since then its run up 500%. Is meta 500% more valuable than it was 2 years ago?

AMD ran up from $2 in 2016 to $160 today. That’s a 8000% increase. Did they start doing 80x the business?

Prices don’t mean shit. Fundamentals don’t mean shit. Nothing means anything. Its bullshit stacked on bullshit stacked on bullshit.There is no inherent meaning to price and value. Its all relative made up bullshit. Its not untrue to say that its all a fugazi. You just gotta appreciate that its all made up before you wade in.

I assume you’re talking about November 2022, because Meta is only up 50% from November 2023. Meta was oversold in 2022 and was at prices not seen since 2015. Do you think Meta was a better company in 2022 than in 2015?

There was a general selloff in tech at the time. You can argue that some companies are overvalued now, but Meta in particular has a PE of 34. It’s probably a bit expensive but it makes a lot of money every year. It’s only issue now is how they can grow once everyone has a Facebook account.

Like, its easy to come up with reasons why things happen after the fact.

You seem to have some decently strong belief that you know whats going on. How much money were you able to make off of Facebooks moves throughout that period?

My guess is you probably didn’t make a bet. Or maybe you did. I’d be actually very interested to hear if you did one way or another. If you bet line go up, you were making a gamble. If you bet line go down, you were making a gamble. If your thesis only predicts the past, what am I supposed to do with it?

And thats my broader point. The rules are made up and the points don’t matter. Its all a game of perception. Are valuations forward facing or are they based on fundamentals? Are fundamentals even relevant in a market this detached or should we really be focusing on Jensen Huangs leather jacket?

Teslas market cap is 512 B. Toyotas market cap is 395 B. Toyota is doing 250 B in revenue and Tesla is doing 20 B in revenue:

If valuations are forward facing, then what are the valuing? If the game was made sense, a simple slide ruler is all you would need to win the game.

The stock market is just voting in the short term but it’s weighing in the long term. Fundamentals work, but sometimes markets are irrational. This is not new. Things have always been this way.

If you don’t like it, you need to invest in Treasury Bills.

Cool, it sounds like you’re getting it. Read “Trading & Exchanges” by Harris and “Reminisces of a Stock Operator” by Lefevre about Jesse Livermoore. Just a suggestion

It’s pretty close to the most shorted stock in history, and none of its fundamentals are good. They’re straight up awful. Like, really, really, really bad.

There is no reason the stock should be worth more than a few pennies. If that.

Talking about it like it’s comparable to other stocks is completely ignoring literally every single data point in the market. Every. One.

So, you’re either completely ignorant of how the stock market works, and shouldn’t be listened to; or you’re aware of all of this and trying to create some sense of normalcy for the bullshit that is DJT, in which case you also shouldn’t be listened to.

It doesn’t really matter which one it is, honestly. The result is the same. You’re not to be listened to :)

Like, you aren’t really worth replying to because you’ve got it so fucking backwards, but if you think this stock is that bad, then put your money where your mouth is and buy puts.

I’ve explained it elsewhere so you can paw around and find the longer form explanation, but in a stock market fully detached from fundamentals, making along bet on this stock is betting on a Trump win in November. What price would you think this stock is worth if Trump is once again in the white house?

AMD was worth 18 dollars. Then it was worth two. Now its worth 160. What does a stocks price mean did the actual value of the company swing that much?

Meta dropped 250 billion in value in a single trading session. What did that mean?

How about Nikola. They rolled a prop without any parts that could be considered vehicular down a hill. Their stock was a literal rocket. Its now worth 1/100th that price, and yet they still have a 800 million dollar market cap.

See its either that no stock prices make sense and its all horse shit, or that things are based in fundamentals, and you are just measuring the wrong things. You can’t have it both ways.

If you think you know more than me, then saddle up to the bar and down load some trading app and give the hog a crank. I’m doing just fine making decisions on how I think things work. If you are so confident in your world view, bet on it.

Why in the world would I want to short the most volatile and expensive to short stock in the world? There’s so many fucking puts on this that it’s one of the major things artificially driving up the stock price.

There’s no way I’m going anywhere near that fucking pile of dogshit.

But you are right about the market being disconnected from fundamentals. Additionally, you’re right about it going up like crazy if he makes it back into the white house